MSCI World vs FTSE All World: Which is the Better Investment?

msci world vs ftse all world Investing in the global market can be exciting but also confusing. Two popular options are the MSCI World and FTSE All World indices. Both aim to represent a large portion of the global stock market. However, there are key differences between them. Let’s explore these differences to help you make informed investment decisions.

MSCI World vs FTSE All World: Which Index is Right for You?

Learn about the key differences between MSCI World and FTSE All World indices. Discover which index aligns with your investment goals and risk tolerance. Make informed investment decisions.

What is the MSCI World Index?

The MSCI World Index is a widely recognized benchmark that measures the performance of large and mid-cap equities across developed markets. It includes countries like the United States, Japan, the United Kingdom, and others. This index is popular among investors who want exposure to established economies.

What is the FTSE All World Index?

The FTSE All World Index takes a broader approach. It covers both developed and emerging markets. This means it includes countries like China, India, and Brazil, in addition to developed nations. If you believe emerging markets have the potential for higher growth, the FTSE All World Index might be more appealing.

Key Differences Between MSCI World and FTSE All World

Market Coverage

The MSCI World focuses solely on developed markets, while the FTSE All World includes both developed and emerging markets.

Diversification

The FTSE All World offers greater geographic diversification due to its inclusion of emerging markets.

Risk

Investing in emerging markets can be riskier than investing in developed markets. Therefore, the FTSE All World generally has a higher risk profile.

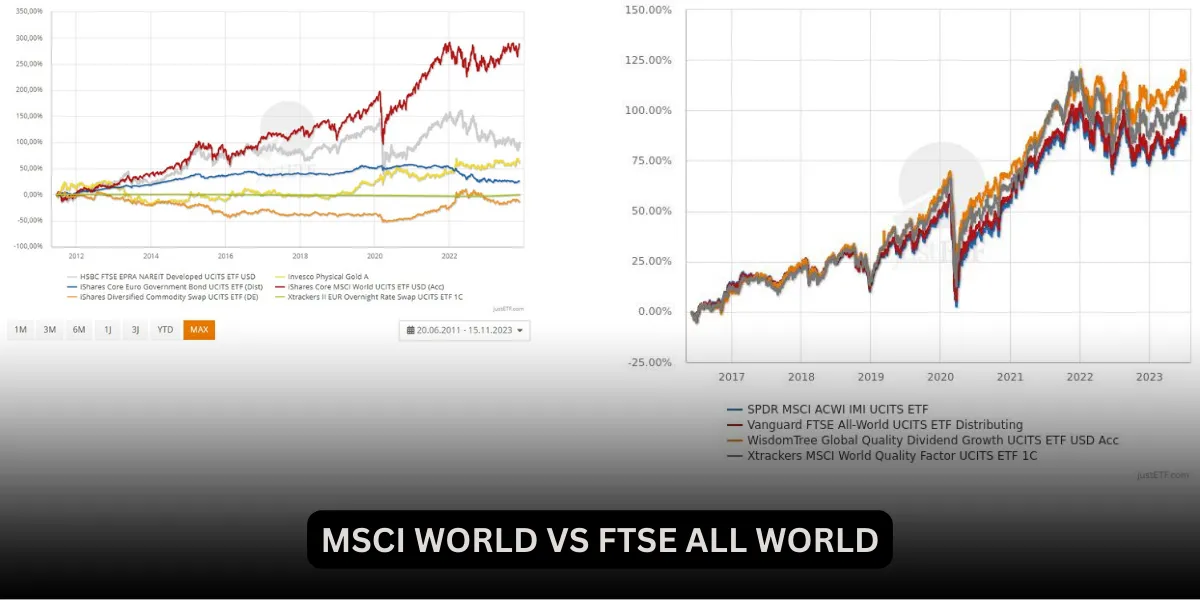

Performance

Historically, developed markets have often outperformed emerging markets. However, this trend can change, and past performance is not indicative of future results.

Which Index is Right for You?

Choosing between the MSCI World and FTSE All World depends on your investment goals and risk tolerance.

If You Prioritize Stability and Lower Risk

The MSCI World might be a suitable choice. It provides exposure to mature economies with established companies.

If You Are Seeking Higher Potential Returns and Are Comfortable with More Risk

The FTSE All World could be considered. It offers exposure to both developed and emerging markets, which can lead to higher growth but also increased volatility.

If You Have a Long-Term Investment Horizon

Diversification is key. Consider investing in both indices to balance risk and reward.

Factors to Consider

Your Investment Goals

Are you looking for steady growth or higher potential returns?

Your Risk Tolerance

How comfortable are you with market fluctuations?

Your Investment Horizon

How long do you plan to invest?

Diversification

Do you already have exposure to other asset classes?

Conclusion

Both the MSCI World and FTSE All World indices offer valuable opportunities for investors. For making wise judgments, it is essential to comprehend their primary distinctions. artistic gymnastics olympics: A Symphony of Strength and Grace It’s essential to conduct thorough research or consult with a financial advisor before investing.