Compass Diversified Holdings Stock Price on the Rise: What Investors Need to Know (July 18, 2024)

compass diversified holdings stock price Compass Diversified Holdings (CODI), a company that invests in a variety of businesses, has seen its stock price climb recently. This news article dives into the details of CODI’s recent performance, analyzes factors influencing the price, and explores what investors should consider before making any decisions.

Understanding Compass Diversified Holdings

Compass Diversified Holdings isn’t your typical company. Instead of creating or selling a single product or service, CODI focuses on acquiring and managing a portfolio of businesses across various industries. These businesses can be manufacturers, distributors, or service providers, with a focus on North American companies.

Recent Stock Price Increase

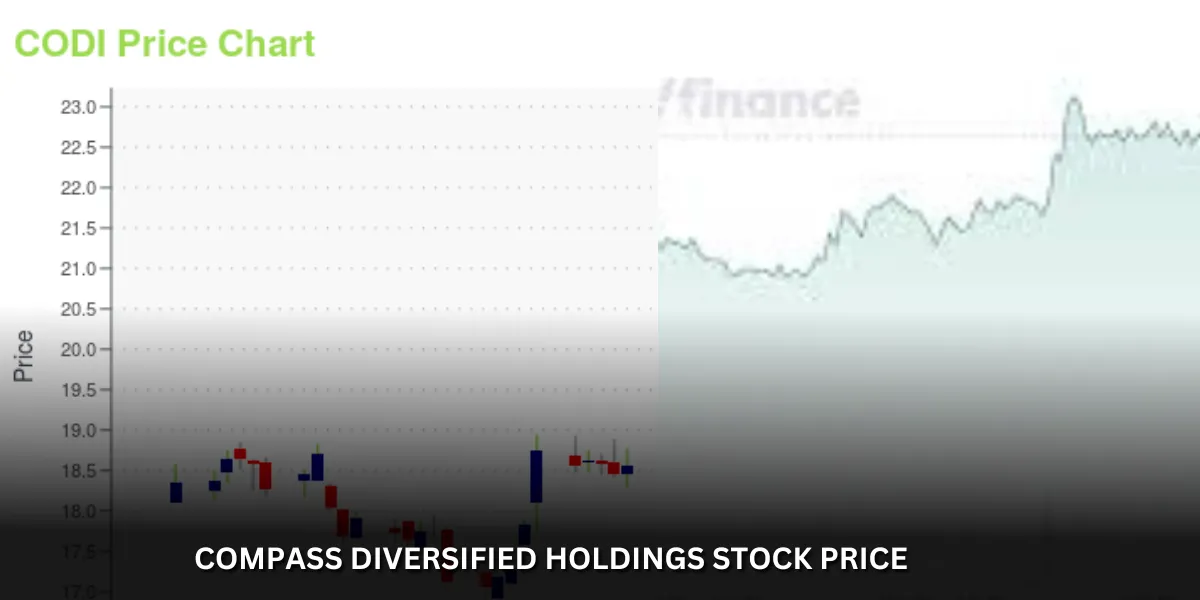

As of July 18, 2024, CODI’s stock price sits at around $24.00, reflecting a rise of over 1% compared to its opening price that day. This increase follows a positive trend observed in recent weeks.

Factors Affecting CODI’s Stock Price

Several factors can influence the price of CODI’s stock. Here’s a breakdown of some key elements:

- Performance of Subsidiary Businesses: The overall health and profitability of the businesses within CODI’s portfolio significantly impact its stock price. Strong financial performance from these subsidiaries translates to increased investor confidence, often leading to a price rise.

- Market Conditions: Broader market trends also play a role. If the overall stock market is experiencing a positive upswing, CODI’s stock price might benefit from that momentum. Conversely, a bearish market could see a decline in CODI’s price.

- Investor Sentiment: News, announcements, and analyst ratings regarding CODI or its subsidiaries can influence investor sentiment. Positive news can boost investor confidence, driving the price up. Conversely, negative news could trigger a sell-off, leading to a price drop.

Is CODI a Good Investment?

Whether CODI is a good investment for you depends on your individual financial goals and risk tolerance. Here are some points to consider:

- Investment Strategy: Since CODI’s value is tied to the performance of its subsidiaries, it offers a diversified investment option. This can be attractive for investors seeking to spread risk across different industries.

- Growth Potential: The potential for growth within CODI’s portfolio companies can be a positive factor. Investors looking for companies with room for expansion might find CODI appealing.

- Dividend History: CODI has a history of paying dividends to its shareholders. This can be a source of regular income for investors seeking dividend-paying stocks.

- Market Volatility: As with any investment, CODI’s stock price can fluctuate. Investors with a low tolerance for risk might need to consider this volatility.

Further Research Before Investing

It’s important to do extensive study before making any investment selections. Here are some steps you can take:

- Review CODI’s Financial Statements: Analyze the company’s financial health, past performance, and future outlook. This information can be found in CODI’s annual reports and filings with the Securities and Exchange Commission (SEC).

- Research CODI’s Subsidiary Businesses: Understanding the businesses within CODI’s portfolio can provide valuable insight into the company’s overall health and potential for growth.

- Read Analyst Reports: Financial analysts often publish reports with their recommendations on stocks like CODI. These reports can offer valuable insights and perspectives.

- Consult with a Financial Advisor: A qualified financial advisor can help assess your individual financial situation and risk tolerance and offer personalized investment advice.

Conclusion

Compass Diversified Holdings’ recent stock price increase has captured investor attention. compass diversified holdings stock price While the company offers a diversified investment option with growth potential and a history of dividends, thorough research is crucial before making any investment decisions. By considering the factors influencing CODI’s stock price, your investment goals, and risk tolerance, you can make informed choices regarding potential investment in this company.